A financial market unites purchasers and sellers to exchange financial resources, for example, stocks, securities, items, derivatives, and other monetary resources. The motivation behind a financial market is to set costs for worldwide exchange, raise capital, and move liquidity and risk. In spite of the fact that there are numerous segments to a monetary market, two of the most normally utilized are money markets and capital markets. Fyers web helps you in finding most relative and safe market instrument for investment and provides other related service.There are 2 types of market operating in India:

Money market

The money market is frequently gotten to nearby the capital markets. While financial specialists are eager to take on more hazard and have the persistence to put resources into capital markets, money markets are a decent spot to “park” reserves that are required in a shorter period, generally one year or less. The monetary instruments utilized in capital markets incorporate stocks and securities, yet the instruments utilized in the money markets incorporate stores, insurance advances, acknowledgments, and bills of trade. Organizations working in money markets are national banks, business banks, and acknowledgment houses, among others.

Money markets give anvariety of capacities to individual, corporate, or government substances. Liquidity is frequently the fundamental reason for getting to money markets. At the point when momentary derivativesis given, it’s entirely expected to cover working costs or working capital for an organization or government and not for capital enhancements or enormous scale ventures. Organizations might need to contribute supports medium-term and look to the money market to achieve this, or they may need to cover finance and look to the money market to help.

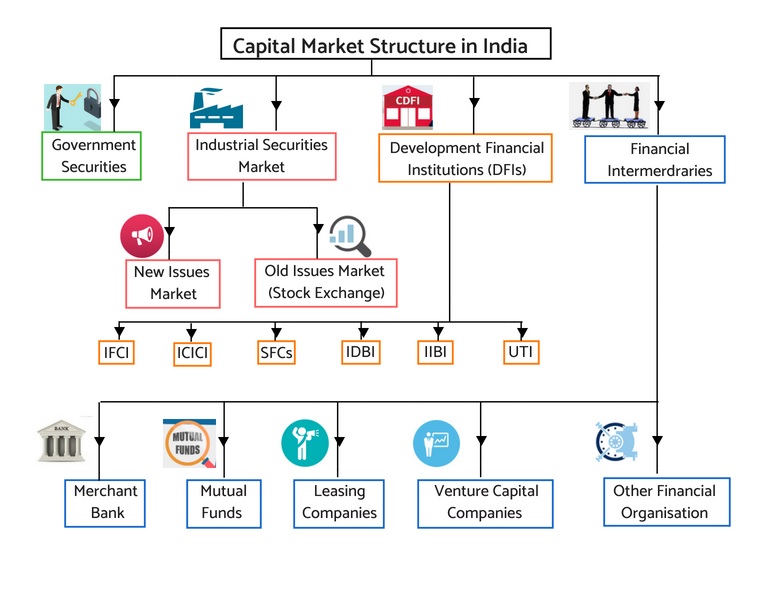

Capital Markets

Capital markets are maybe the most broadly followed markets. Both the stock and security markets are firmly followed, and their every day developments are investigated as intermediaries for the general financial state of the world markets. Accordingly, the foundations working in capital markets—stock trades, business banks, and a wide range of organizations, including non-bank establishments, for example, insurance agencies and home loan banks—are deliberately examined.

The institution working in the capital markets get to them to raise capital for long haul purposes, for example, for a merger or procurement, to grow a line of business or go into another business, or for other capital ventures. Substances that are fund-raising for these long haul purposes come to at least one capital markets. In the security showcase, organizations may give derivatives as corporate securities, while both neighborhood and national governments may give derivatives as government securities. Fyers reviewis most reliable for investing your money in stock market.

So also, organizations may choose to fund-raise by giving value on the securities exchange. Government substances are ordinarily not freely held and, along these lines, don’t for the most part issue value. Organizations and government elements that issue value or derivatives are viewed as the dealers in these business sectors.

The purchasers (or the financial specialists) purchase the stocks or derivatives of the merchants and exchange them. On the off chance that the seller (or backer) is setting the securities available just because, at that point the market is known as the essential market.